VHB is teaming up with Rhino Capital Advisors LLC, a Boston-based commercial and real estate investment and development firm, to redevelop the former Lakeville State Hospital into 450 mixed-residential housing units. The 402,500-square-foot development will include multi-family, assisted living and memory care, and senior housing. The site will also feature community amenities such as publicly accessible walking trails and recreational areas.

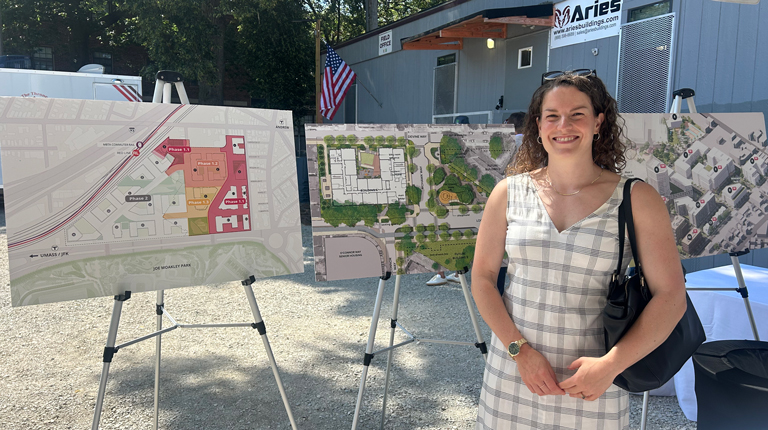

The mixed-residential project has been well received by the community. Rhino held two community engagement meetings, which the VHB project team attended to show Lakeville residents renderings of the development and allow for the public to informally ask questions about the project and provide development input for the project team's consideration.

Plans for redevelopment of the hospital, which closed in 1992 and has remained dormant since, involved several design and permitting challenges, including wetlands, varying topography, and lack of sewer infrastructure.

Rhino first engaged VHB in the early stages of the project to assist Rhino in envisioning the property's maximum redevelopment potential, which involved comparing the impact to cost, schedule, and permitting requirements for each of the redevelopment options. Our team also completed environmental assessments to determine the status of historic contamination on the property, including an unregistered landfill. Once the conceptual planning and site due diligence was complete, VHB provided permitting, survey, site and civil, site investigation and remediation, traffic, and environmental services to support the project through the local approvals process.

The project has received local approvals from the Town of Lakeville and has recently completed the Massachusetts Environmental Policy Act (MEPA) review process. VHB will continue to support Rhino with the redevelopment project as the project looks to advance towards construction in the coming months.

Read how VHB partners with clients across all markets to unlock development potential through asset repositioning.